Programs

“Empower the Next Generation of Financial Leaders!

Golf & Finances

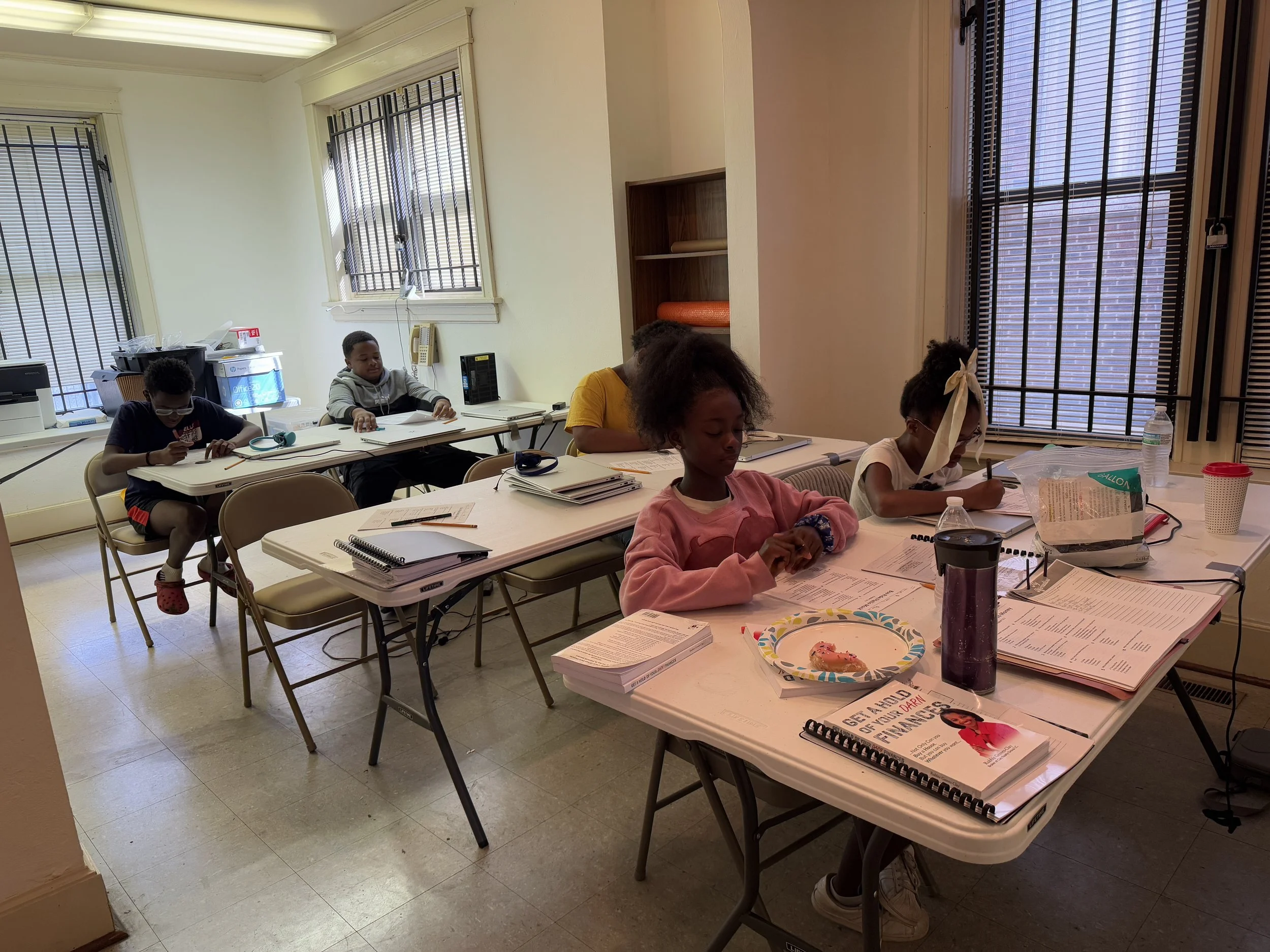

This summer, Series of Gifts partnered with the College Hill Foundation Golf Program to bring a powerful mix of skills to our youth—teaching them how to succeed on the golf course and in their financial lives.

Through our Get A Hold Of Your Darn Finances (GAHOYDF) program, students learned how to budget, save, and invest—essential tools for building a strong financial future. But we didn’t stop there. We also raised funds to open bank accounts for every student who completed the program, giving them the opportunity to practice smart money management from day one.

Our goal is simple: equip young people with the confidence and skills to make informed financial decisions, avoid debt, and build a foundation for long-term success. The discipline, focus, and strategic thinking they develop in golf mirror the same principles they’ll use to master their money.

Together with the College Hill Foundation Golf Program, Series of Gifts is creating opportunities that will impact these students for a lifetime—on and off the green.

What They Learned…

This one-on-one coaching package is designed for individuals who want to take control of their finances through strategic budgeting. You’ll receive personalized coaching, custom budget templates, and detailed guidance on managing your income, cutting expenses, and creating a sustainable financial plan. Plus, you’ll get follow-up support to keep you on track and ensure steady progress toward your financial goals.

Comprehensive Financial Literacy Course: The course covers important topics like budgeting, saving, investing, and credit management, giving each child a solid foundation in how to manage money.

Budgeting Basics: Students learn how to create a budget, track their spending, and understand how their money choices affect their future goals.

Saving and Goal Setting: The program teaches kids how to save money for both short-term needs and long-term goals, such as building an emergency fund or saving for big purchases.

Introduction to Investing: We introduce the basics of investing, showing kids how to grow their money over time and explaining different types of investments.

Credit Management: Students learn about credit scores, how credit works, and how to use it responsibly to avoid debt and ensure financial stability.

Bank Account Setup: After completing the course, the funds raised will be used to open a real bank account for each child, providing them with the opportunity to practice managing their own money.

Practical Money Skills: The program focuses on real-life money skills, teaching kids how to make smart decisions, manage money well, and understand the consequences of poor financial choices.

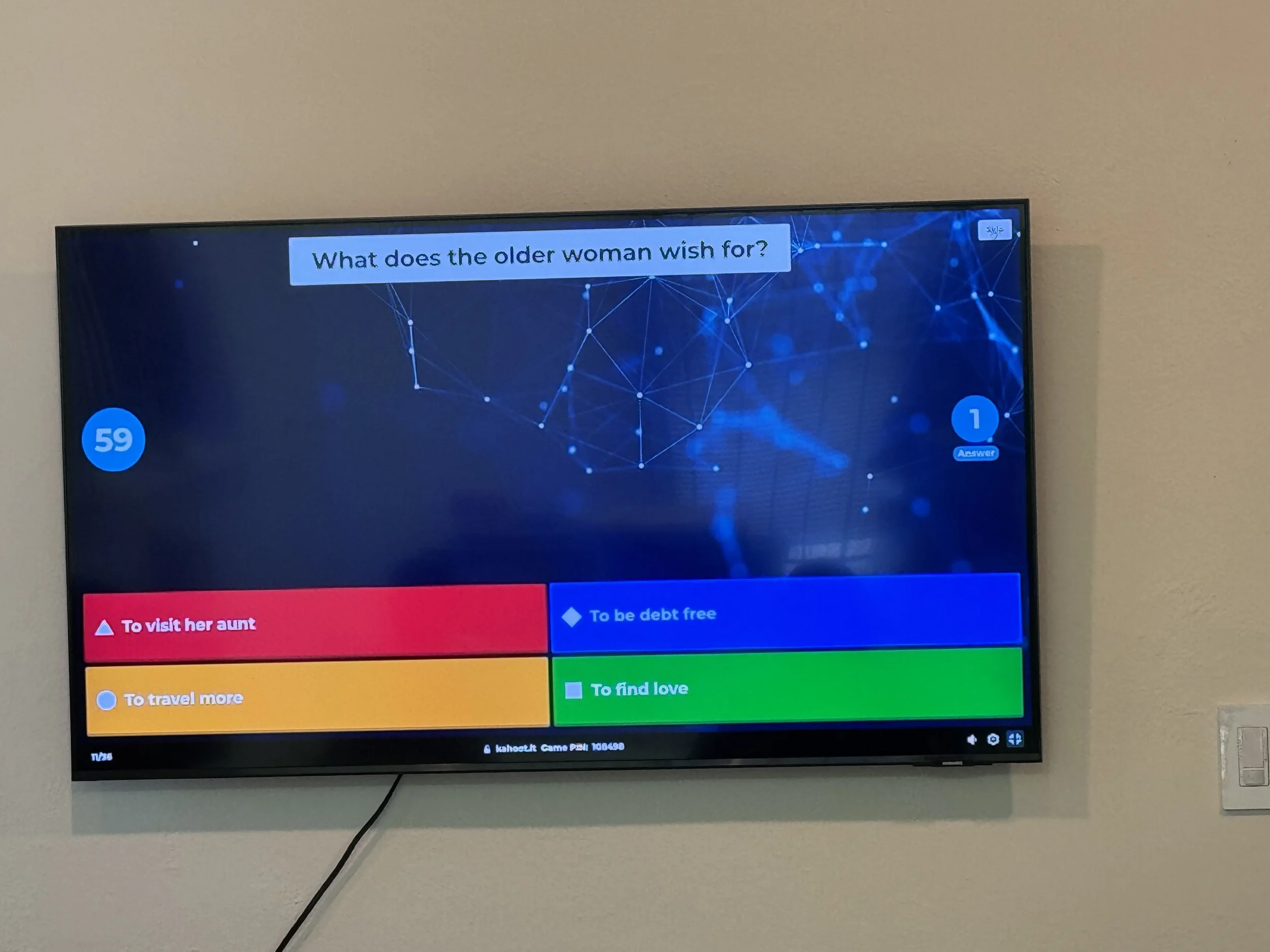

Quizzes and Weekly Tests: To ensure understanding, students will take weekly quizzes through Kahoot in fun, interactive game formats. These games make learning engaging and help reinforce key financial concepts, ensuring they’re ready to apply their knowledge in real life.

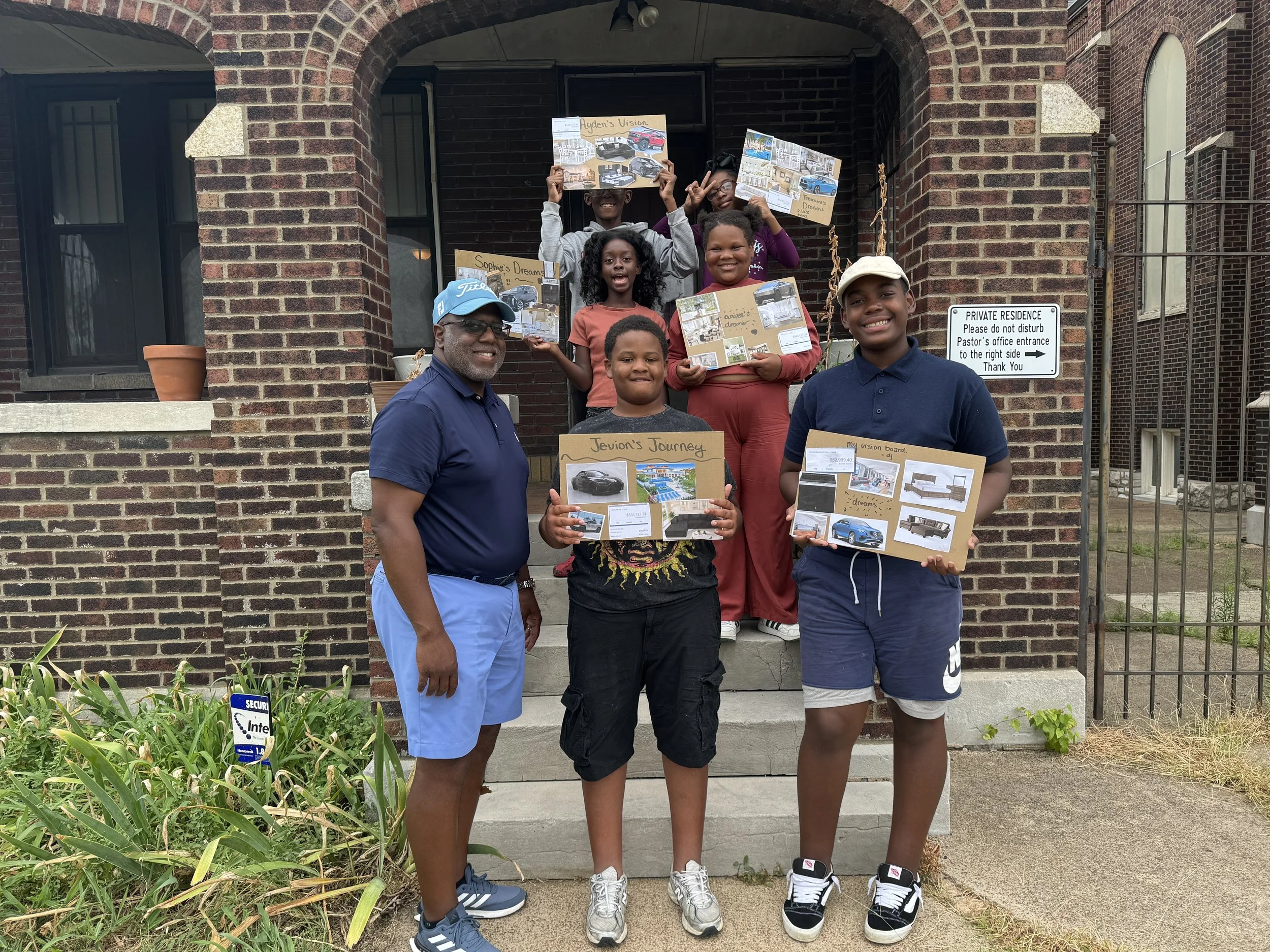

Goal Setting/ Vision Boards - Each young adult designed a personal vision board that showcased their dreams and financial goals. These boards served as powerful visual reminders of their aspirations, motivating them to take consistent, intentional steps toward making them a reality.

Earn To Learn

During our academic day, each young adult started with $25 in play money as part of our interactive Get A Hold Of Your Darn Finances (GAHOYDF) lessons. But thanks to the support of our not-for-profit, Transformational Education Services, Inc. (TES), those symbolic dollars turned into real funds. The experience went far beyond theory—students applied the principles they learned in budgeting, saving, and smart spending to qualify for actual bank accounts in their names.

We are calling on sponsors to help us make this opportunity a reality for more students. A contribution of $250 per child provides the seed money for their new account upon completing the program—an account they’ve truly earned by following our rules, attending every session, and actively participating. Your support doesn’t just teach financial literacy; it gives these young people a tangible start on their financial journey, empowering them to manage money wisely and build a foundation for a brighter future.